Quick Facts

- E-commerce entrepreneurs targeting Swiss market

- Dropshippers seeking high purchasing power customers

- Luxury and wellness niche sellers

- New 2025 VAT rules require platforms to collect 8.1% VAT directly; duty-free limit dropped to 150 CHF

- 5-Franken Regel: goods under ~62 CHF can pass tax-free if VAT is under 5 CHF

- Local suppliers like Shopcom.ch offer 1-3 day shipping and neutral packaging to avoid customs issues

- Business registration becomes mandatory at CHF 100,000 annual revenue with ~10% social security costs

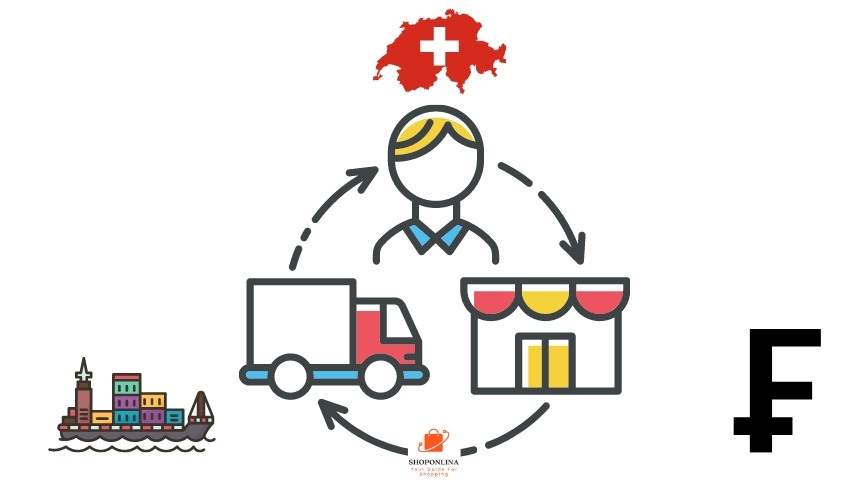

Switzerland offers lucrative dropshipping opportunities with $1,674 average online spending per person, but requires using local suppliers, understanding new VAT regulations, and focusing on high-ticket items to offset premium shipping costs.

Switzerland is an anomaly in the European e-commerce market. It combines some of the highest purchasing power in the world with a fortress of customs regulations that scares away most amateurs. If you get it right, you are selling to a demographic that ranks among Europe’s highest in online purchasing power, with per‑capita e‑commerce spend consistently above the European average. If you get it wrong, your margins will be eaten by the new VAT rules effective since January 2025.

Most guides tell you dropshipping here is easy. It isn’t. It requires specific knowledge of the ‘5-Franken Regel’, local logistics, and the specific consumer behavior of the Swiss. This isn’t just about listing products; it’s about navigating a non EU market in the heart of Europe.

The Reality: Why Switzerland is Different

Unlike dropshipping in the EU, where goods move freely across borders, Switzerland manages its own borders strictly. As of 2025, the market was valued at over USD 18 billion and is projected to exceed USD 20 billion in 2026, but accessing it still requires a strategy that accounts for friction.

The biggest change entering 2026 is the ‘Plattformbesteuerung’ (Platform Taxation). Since January 1, 2025, major marketplaces must collect VAT (8.1% standard) directly. Additionally, the duty‑free limit for travelers importing goods for personal use dropped from 300 CHF to 150 CHF as of January 1, 2025. This means the days of shipping expensive items tax-free to Swiss customers are largely over.

Top Verified Swiss Dropshipping Suppliers (2025/2026)

To avoid customs headaches, the smartest move is to use suppliers who already have stock inside Switzerland. Here are the top providers vetted for the 2026 season:

1. Shopcom.ch (General Merchandise)

Based in Büron (LU), Shopcom is a reliable local partner carrying over 10,000 products, from Pokémon toys to household goods. They are the definition of “Swiss efficiency.”

- Shipping: Orders placed before 10:00 AM are delivered in 1-3 days.

- Cost: Standard shipping is 12 CHF (up to 30kg). Bulky goods cost 18 CHF.

- The Pro: They use neutral delivery notes, so your customer never knows it came from them.

2. BrandsGateway (Luxury Fashion)

If you are targeting the high-end Swiss consumer, Zalando isn’t your only competition. BrandsGateway offers access to brands like Gucci and Versace.

- The Trade-off: It’s expensive. Subscriptions start around $295/month.

- Speed: Shipping to Switzerland takes 3-7 business days from EU warehouses.

- Verdict: Only for serious sellers with marketing budget.

3. Formula Swiss (CBD & Wellness)

For the wellness niche, Formula Swiss offers a manual dropshipping program with high margins.

- Margin: You typically get a 30% discount on orders.

- Shipping: Flat rate of 4.95 EUR for dispatch within Switzerland.

- Tip: Look for promo codes like ‘CBD10LIFE’ to squeeze out extra margin.

Financial Friction: Costs & Taxes

Forget the myth that you can start with zero capital. While cheaper than a brick and-mortar store, a legitimate Swiss dropshipping setup has costs you must budget for.

- Registration: If you scale, registering a sole proprietorship (Einzelfirma) costs between CHF 120 and CHF 150. This becomes mandatory once your annual revenue hits CHF 100,000.

- Social Security: Expect to pay roughly 10% of your income into AHV/IV/EO (Swiss social security).

- Customs Duties: While industrial tariffs dropped to 0% in 2024, you still deal with the VAT. Under the 5-Franken Regel, if the VAT amount is under 5 CHF, it’s waived. This means goods under roughly 62 CHF (at 8.1% VAT) can often slide through tax-free.

For a deeper dive into logistics near the border, check our guide on Amazon FBA Germany, which many Swiss sellers use as a secondary strategy.

How to Start (The Practitioner’s Checklist)

Don’t just “open a store.” Follow this workflow to minimize risk:

- Step 1: Pick a High Ticket Niche. Shipping in Switzerland is expensive (Swiss Post is premium). Selling cheap 5 CHF gadgets won’t cover your margins. Focus on items where a 12-15 CHF shipping fee feels negligible to the buyer.

- Step 2: Localize Your Store. Swiss buyers trust.ch domains and payments via TWINT (the local mobile payment favorite). If you only offer PayPal, you will lose sales.

- Step 3: Secure Supply. Use local suppliers like Swiss wholesalers or verify that your international dropshipper handles the DDP (Delivered Duty Paid) shipping terms so your customer isn’t hit with a customs bill at the door.

Common Pitfalls to Avoid

The Amazon Misconception: Many new sellers think they can just dropship on Amazon.ch. As of late 2025, Amazon.ch is still largely a portal directing traffic to European sites; it does not host a dedicated third-party marketplace for Swiss sellers in the same way Amazon.de does. If you want to use marketplaces, look at Galaxus or Ricardo.

Ignoring Returns: Swiss law doesn’t mandate a “right of withdrawal” for online purchases in the same strict way the EU does, but Swiss customers expect it. If you don’t offer a local return address (like the service offered by Shopcom), your conversion rate will suffer.

Final Verdict

Dropshipping in Switzerland is not a “get rich quick” scheme. It is a legitimate logistics business that requires navigating VAT laws and customs thresholds. However, with high purchasing power and less saturation than the US or UK markets, the profit potential for 2026 is massive for those who professionalize their approach.