Quick Facts

- Entrepreneurs starting dropshipping businesses

- E-commerce sellers targeting German market

- Small business owners navigating EU regulations

- Germany requires trade registration (Gewerbeanmeldung) and LUCID packaging register compliance to operate legally

- 2025 tax update: Kleinunternehmerregelung threshold increased to €25,000 previous year turnover

- Use EU-based suppliers like CJ Dropshipping (Frankfurt warehouse) for 2-5 day shipping instead of 30-day China shipping

- Amazon Germany holds 57% market share but strictly enforces Seller of Record policy

Germany offers massive e-commerce opportunity ($107.85B market) but requires serious legal compliance including packaging laws, VAT registration, and 14-day return policies—treat it as a professional regulated business, not a side hustle.

Entering the German e-commerce marketprojected to hit $107.85 billion in 2025—is not a “get rich quick” scheme. It is a high stakes environment where strict bureaucracy meets massive opportunity.

While Germany currently ranks as the #5 dropshipping market globally, outperforming Scandinavian neighbors like Sweden and Norway in pure volume, it is also the most legally complex. If you treat this market like the Wild West, you will face fines. If you treat it like a professional business, you tap into Europe’s largest customer base.

This isn’t just about finding a winning product. It’s about navigating the LUCID packaging laws, understanding the 2025 tax updates, and ensuring you don’t get banned from Amazon.

The Reality of Dropshipping in Germany (2025 Update)

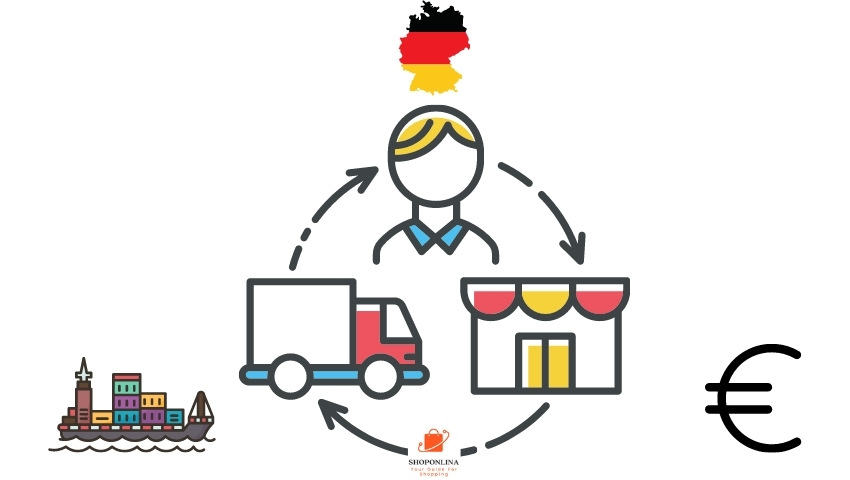

Many gurus sell the dream of “passive income.” In Germany, dropshipping is an active, regulated trade. The fundamental process remains the sameyou sell, the supplier shipsbut the execution has changed drastically this year.

To operate legally in 2025, you must clear these hurdles immediately:

- Trade Registration (Gewerbeanmeldung): You cannot simply start selling. You must register at your local trade office.

- The LUCID Register: Under the Verpackungsgesetz, if you ship packaged goods to German consumers, you must pay for the recycling of that packaging. Failure to register can lead to immediate warnings (Abmahnung).

- Right of Withdrawal (Widerrufsrecht): German law mandates a 14-day return window. You cannot have a “no returns” policy.

If you are looking for general online shopping trends in Germany, you will see that customers expect speed and transparency. This is why choosing the right supplier is not optionalit is survival.

Top Suppliers with European Warehouses

Stop relying on 30-day shipping times from China. German customers will not wait. In 2025, the winning strategy is using suppliers who actually hold stock within the EU.

1. CJ Dropshipping (The Logistics King)

CJ Dropshipping remains a powerhouse because they don’t just facilitate orders; they hold inventory locally. As of late 2025, their primary EU owned warehouse is in Frankfurt am Main. This allows for domestic shipping speeds that compete with Amazon Prime.

2. Nedis (The Electronics Specialist)

If you are in the tech niche, forget AliExpress. Nedis has been operating for 43 years (founded in 1982) and specializes in consumer electronics. Following their acquisition by Commaxx in 2024, their distribution network has only gotten stronger. They offer automated fulfillment for Shopify and WooCommerce via tools like Import2Shop.

3. Spocket (The EU Connector)

Spocket distinguishes itself by vetting suppliers heavily. In 2025, 80% of their suppliers are based in the US or EU, meaning shipping times are typically 2 to 5 days. They integrate seamlessly with Wix, BigCommerce, and Shopify.

Tax & Legal: The “Kleinunternehmerregelung” Update

This is the section that saves you money. Germany has a specific rule for small businesses called the Kleinunternehmerregelung. It allows you to operate without charging VAT (MwSt) if your revenue is low.

Crucial 2025 Update: As of January 1, 2025, the thresholds have increased. You qualify if:

- Your previous year’s turnover was below €25,000 (previously €22,000).

- Your current year’s turnover is not expected to exceed €100,000.

Additionally, the new Wachstumschancengesetz mandates that B2B transactions must handle electronic invoicing (e invoicing) starting Jan 1, 2025. Ensure your accounting software can handle XML based invoices (XRechnung).

Amazon Germany: Proceed with Caution

Amazon holds over 57% of the German online market share. It is the biggest pie, but also the hardest to eat. Amazon Germany strictly enforces a “Seller of Record” policy.

If you dropship on Amazon, you cannot have the package arrive in a Walmart or AliExpress box. You must be identified as the seller on all packing slips. Furthermore, the new Shipping Tracking Policy (Jan 15, 2025) requires a 95% Valid Tracking Rate (VTR). If you miss this metric, your listings will be suspended.

For a deeper dive into logistics for Amazon, read our guide on Amazon FBA Germany to see if FBA might be a safer alternative to direct dropshipping.

Is Dropshipping in Germany Worth It?

Yes, but the era of “easy money” is over. The barrier to entry is higher, which is actually good news for serious entrepreneursit filters out the low quality competition.

The Strategy for 2026:

- Niche Down: Generic stores fail. Focus on high margin categories like wholesale products from Germany or specialized electronics.

- Get Local: Use suppliers with German warehouses (like CJ or Nedis) to ensure 2-3 day delivery.

- Stay Compliant: Register for LUCID and keep your turnover under €25k initially to utilize the small business tax exemption.